Calculate your California net pay or take home pay by entering your perperiod or annual salary along with the pertinent federal, state, and local W4 information into this free California paycheck calculatorUse Gusto's salary paycheck calculator to determine withholdings and calculate takehome pay for your salaried employees in California We'll do the math for you—all you need to do is enter the applicable information on salary, federal and state W4s, deductions, and benefitsW2manager is designed for organizations that need to prepare

Ttb Products

How to calculate 1099 salary

How to calculate 1099 salary- The estimated penalties range from 70%75% or more for every dollar (for nonCalifornia states) you pay a 1099 contractor who is misclassified If you do not know what percentage of your company's 1099s are in compliance with the rules governing the use of 1099s, we recommend using the figure of 62% in your calculations Step 1 Calculate net earnings Gross earnings business expenses = net earnings Step 2 Calculate the amount that equals 9235% of your net earnings, which is the amount subject to selfemployment tax Net earnings X 9235% = the amount subject to selfemployment tax Step 3 Calculate the Social Security portion of selfemployment tax

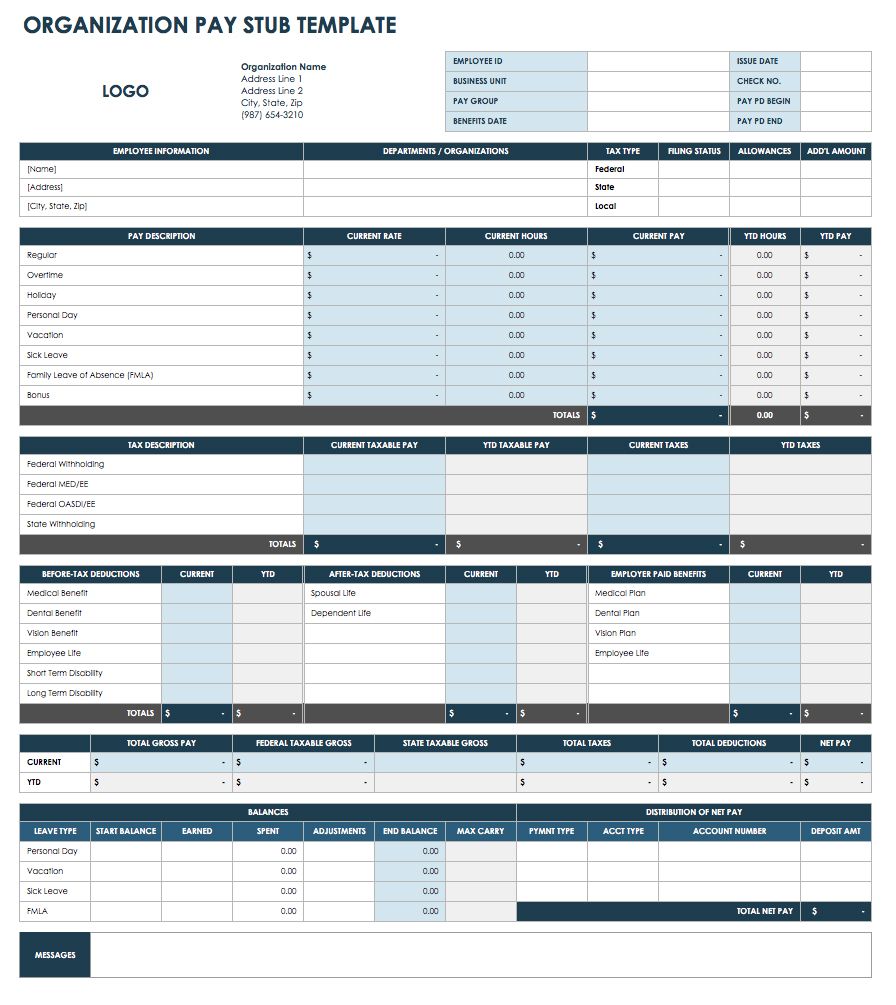

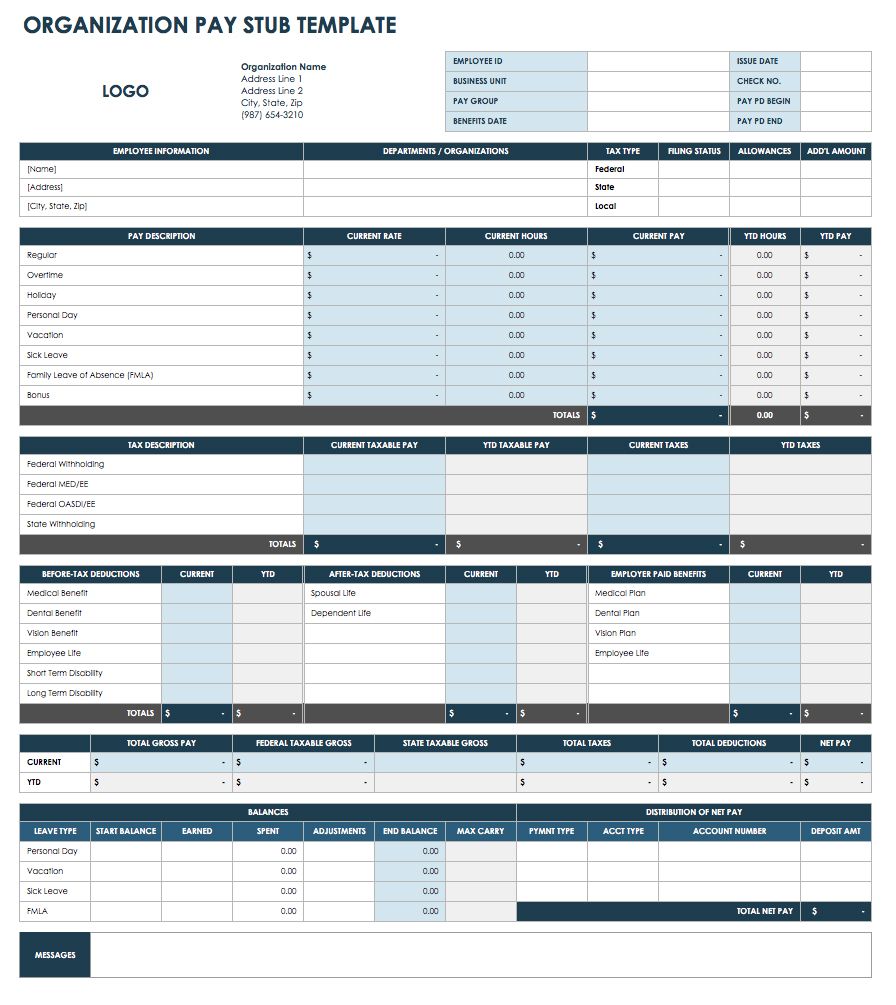

Free Pay Stub Templates Smartsheet

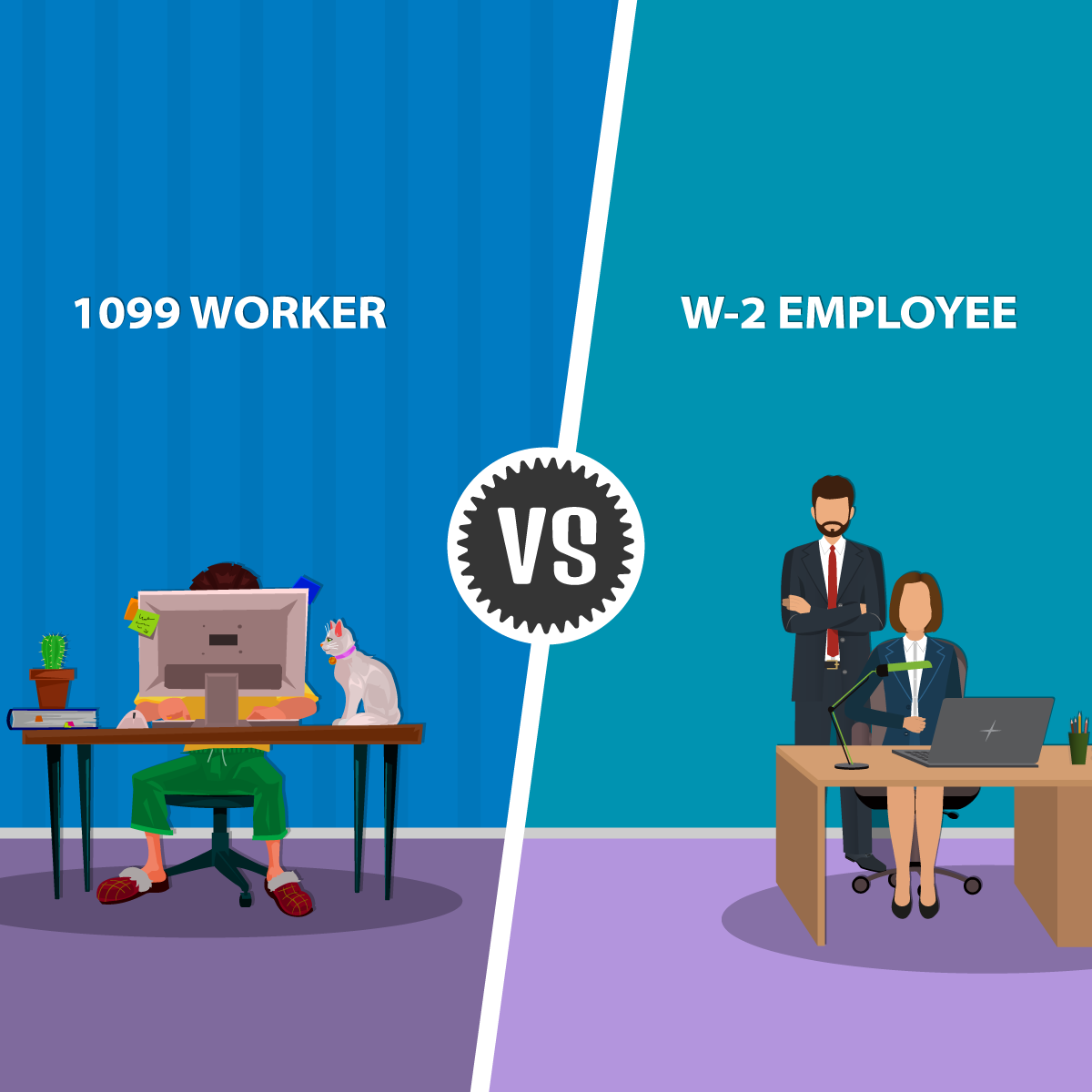

TakeHomePaycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W4 form This calculator is intended for use by US residents The calculation is based on the 21 tax brackets and the new W4, which inThe following table compares the tax liability for a W‐2 employee and a 1099 contractor/self‐employed individual with relatively low business expenses, married with two children, using the tax rate schedules provided by the IRS 1099 W2 1099 W2 1099 W2 1099 W2 1099Use this calculator to determine an annual W2 (salary) amount that is approximately equivalent to an annual 1099 (contract) amount If you are a 1099 (Independent Contractor) worker, the IRS requires you to pay 62% of your reported income (up to $128,400) for the employee's share of Social Security tax, and also requires you to pay another 62% of your income (again, up to

ESmart Payroll Software offers online electronic efile for IRS Tax forms W2 W2C 940 941 1099 MISC 1099C DE9C and efile electronic filing corrections services eSmart Payroll software specializes in online tax filing and efile solutions for form W2 1099 940 941 DE9C and other Payroll SolutionsCalifornia Paycheck Calculator Use SmartAsset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes Overview of California Taxes California Business owners, accountants, and Human Resources employees understand the difficulties associated with payroll calculation In addition to keeping track of all employees' hours, these professionals must carefully calculate the California payroll tax, as well as several other taxes that must be withheldNecessary for each employee and for every paycheck, this fast

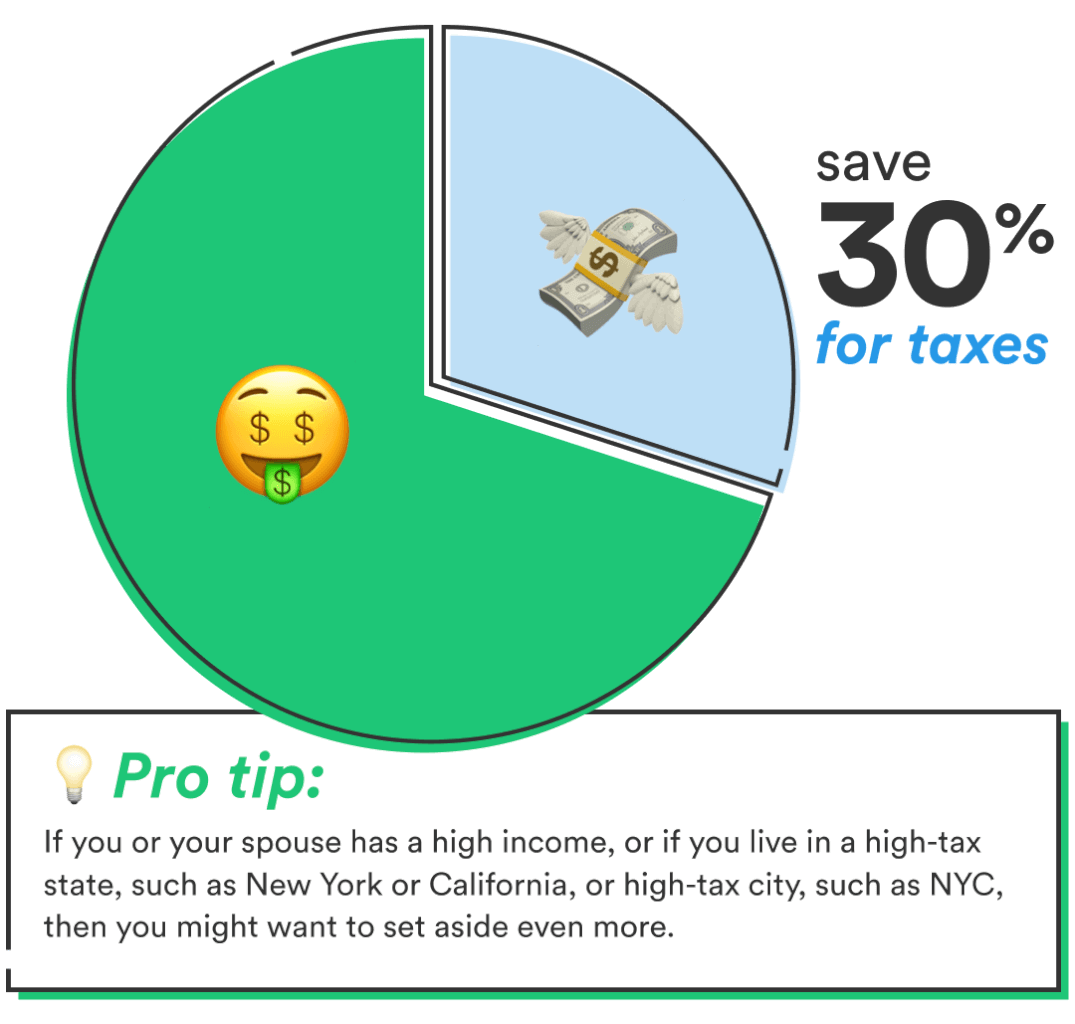

For every dollar you earn as a 1099 worker, you can expect to keep 70 cents for yourself and to pay your fair share of about 30 cents in tax Keeper has a selfemployed tax calculator to quickly estimate how much taxes you'll owe Importance of Deductions & Credits The California self employment tax is divided into two different calculations The first is the 124% Social Security amount that is paid on a set amount, which in will be the first $137,700 of your net earnings The second payment to Medicare is 29%, applied against all your combined net earnings There are some variations if your spouse works for you, you have aOur California Salary Tax Calculator has only one goal, to provide you with a transparent financial situation By seeing how all of your taxes are split up and where each of them go, you have a better understanding of why you pay the tax you do, where the money goes, and

/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png)

How Much Should You Budget For Taxes As A Freelancer

1099 Tax Rate For 21 And 5 More 1099 Worker Tax Tips Stride Blog

1099 c tax calculator Take advantage of a electronic solution to develop, edit and sign documents in PDF or Word format online Convert them into templates for multiple use, include fillable fields to collect recipients? California has among the highest taxes in the nation Its base sales tax rate of 725% is higher than that of any other state, and its top marginal income tax rate of 133% is the highest state income tax rate in the countryWhen the estimator asks you Let's break the navigation down Most accountants would recommend that you use them either for your independent contractors or for yourself Celebrating years of our love for payroll With warm appreciation for our loyal PaycheckCity fans, we've created a new PaycheckCity to better serve your payroll needs If you're a 1099 worker (or a small business

Free Pay Stub Templates Smartsheet

Vermont Income Tax Vt State Tax Calculator Community Tax

Data, put and ask for legallybinding electronic signatures Get the job done from any gadget and share docs by email or faxRecently in 14, the Ninth US Circuit court of Appeals in San Francisco ruled that the drivers of Fed Ex in California are employees With the online paycheck calculator software, you can Calculate paychecks and prepare payroll any time;California Paycheck Calculator Payroll check calculator is updated for payroll year 21 and new W4 It will calculate net paycheck amount that an employee will receive based on the total pay (gross) payroll amount and employee's W4 filing conditions, such us marital status, payroll frequency of pay (payroll period), number of dependents or federal and state exemptions)

Lyft 1099 Taxes Guide

W 2 1099 Here S What You Need To Know About Your Employment Status Nailpro

Paycheck Calculator, Payroll Tax Software, W2 & 1099 Management and Efile Services PaycheckManager – Free paycheck, payroll tax calculator, print paychecks & pay stubs Innovative, flexible, patented online payroll management softwareOur Folsom tax planning attorneys provide a guide for an efficient way to calculate your selfemployment taxes if you are self employed in California In other words, the more money that you make, will increase how much taxes will you pay on 1099 income Fortunately, this tax is imposed on your net earnings, not gross revenues So, if you make $100,000 and spend $60,000, the tax will be imposed on the $40,000 net profit This is why business deductions are probably going to become your

Www Ftb Ca Gov Help Free Tax Help 5135 Pdf

1099 Taxes Calculator Estimate Your Self Employment Taxes

Simple Payroll is a full service, online payroll where we will make tax deposits and file payroll reports for you;Income Tax Calculator Knowing how much you need to save for selfemployment taxes shouldn't be rocket science Our calculator preserves sanity, saves time, and destresses selfemployment taxes in exchange for your emailYour 19 or income is the sole proprietorship's net profit However, payroll taxes are one constant Basics For Filing Independent Contractor Paycheck Form 1099MISC for Small Businesses By Jan It's Free to Try!

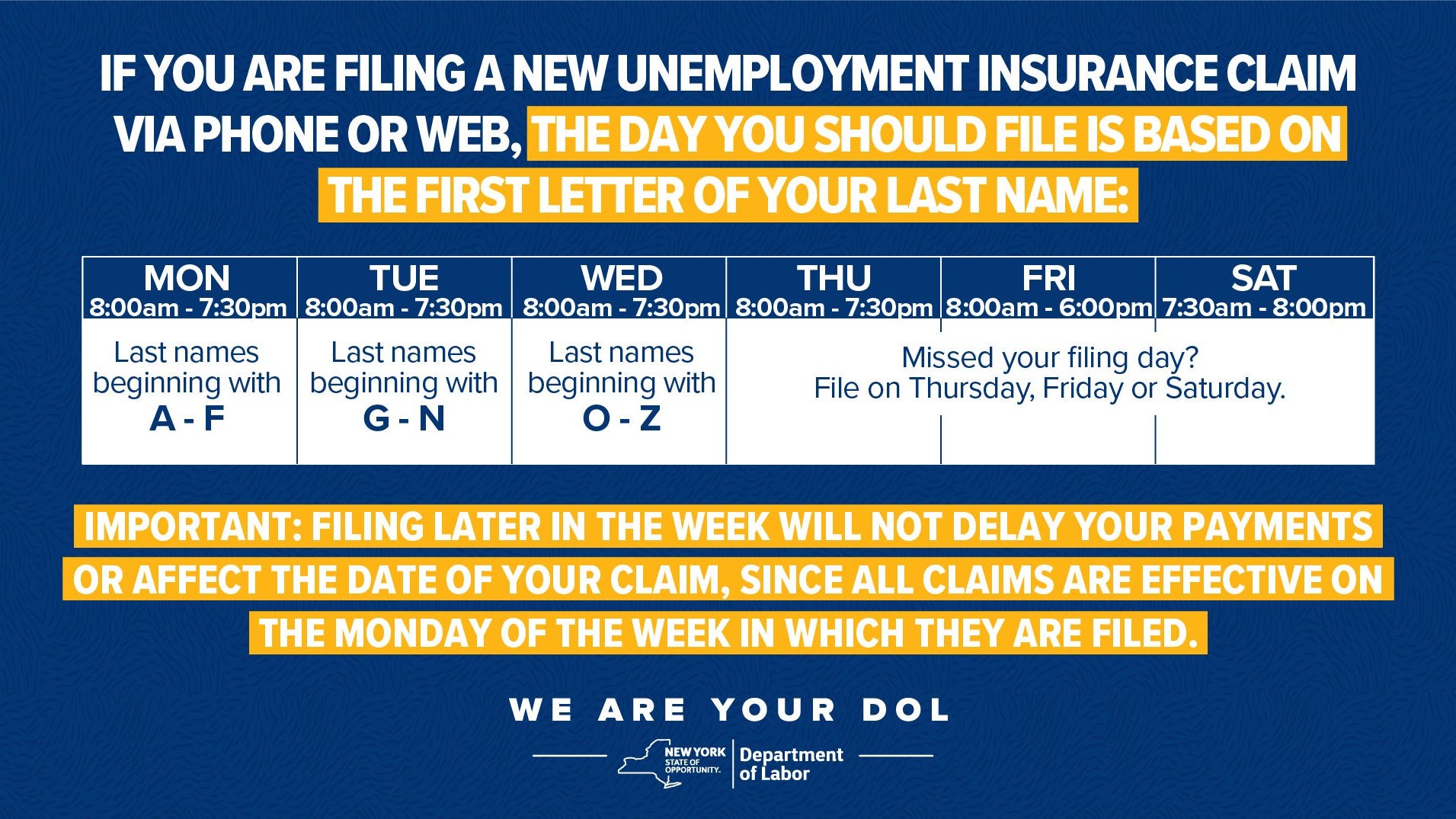

Beware Of The Unemployment Benefit Tax Bite What You Need To Know

63 000 00 Tax Calculator 21 22 21 Tax Refund Calculator

You will pay an additional 09% Medicare tax on the amount that your annual income exceeds $0,000 for single filers, $250,000 for married filing jointly, and $125,000 married filing separate Use this calculator to estimate your selfemployment taxes This information may help you analyze your financial needsFor tax year 10 the following California Payroll Taxes are in effect 10 PIT Withholding – California provides two methods for determining the amount to be withheld from wages and salaries for state personal income tax Method A – Wage Bracket Table Method and Method B – Exact Calculation Method California Law to make 1099 employees Hourly staff Attendance Tracking Assembly Bill 5 (AB5), passed in California last year and which recently went into effect on January 1 st, places severe restrictions on how businesses can contract and work with independent workers This law not only affects the rise of freelance work through the "gig

Www Ftb Ca Gov Forms 540 Booklet Pdf

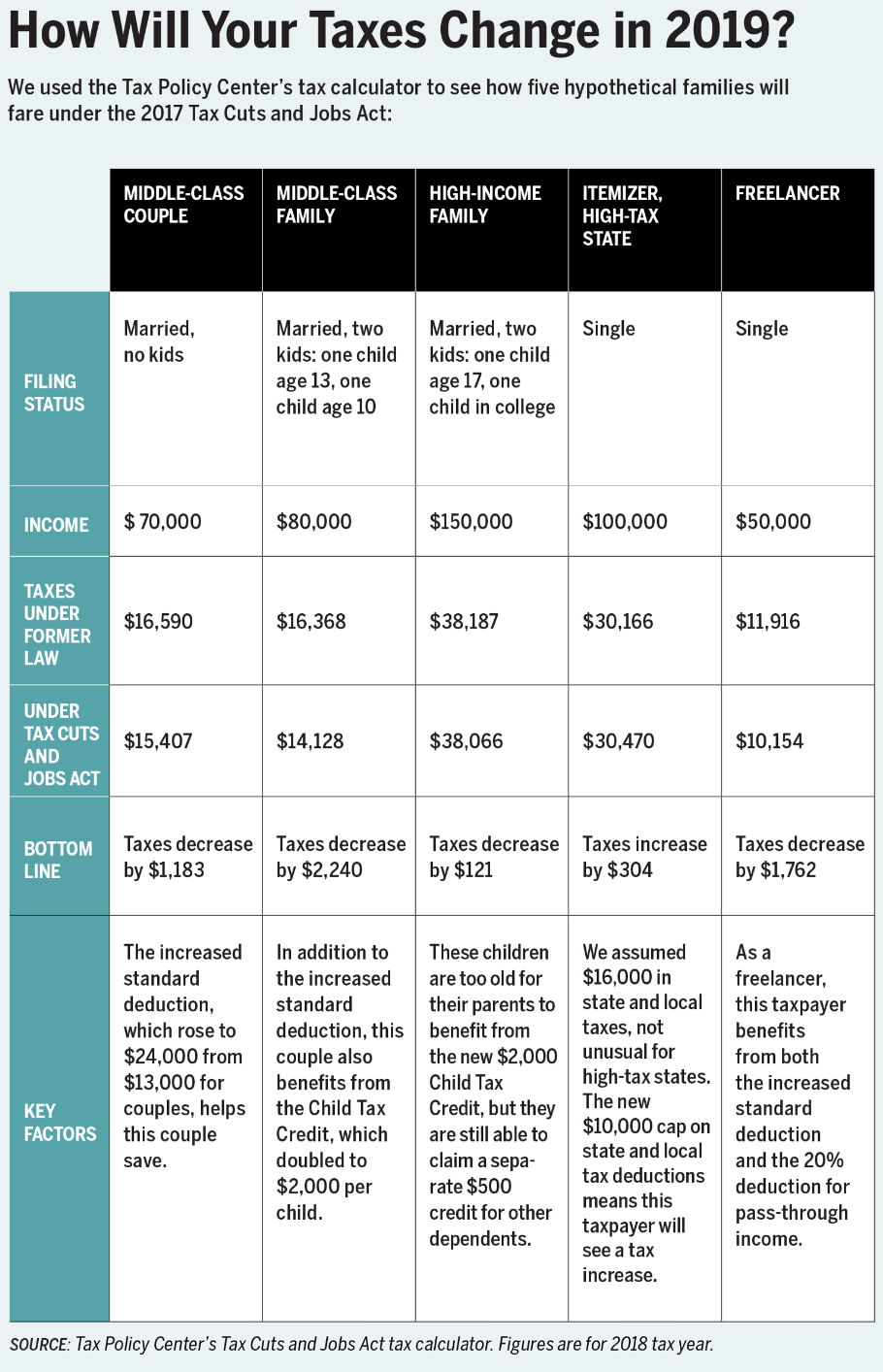

How Will The Tax Reform Affect W 2 And 1099 Tax Filings

Need help calculating paychecks?Coupling this with California's expensive income liability makes it one of our worst states for LLCsCalifornia Payroll Taxes New State Law, Mandatory efile of Payroll Taxes and Reports Employers in California are required to electronically submit employment tax returns, wage reports, and payroll tax deposits to the Employment Development Department This rule went into effect on

Www Caltax Com Spidellweb Public Marketing Downloads Cat Sample Issue Pdf

Federal Tax 80k Salary Example Us Tax Calculator 21

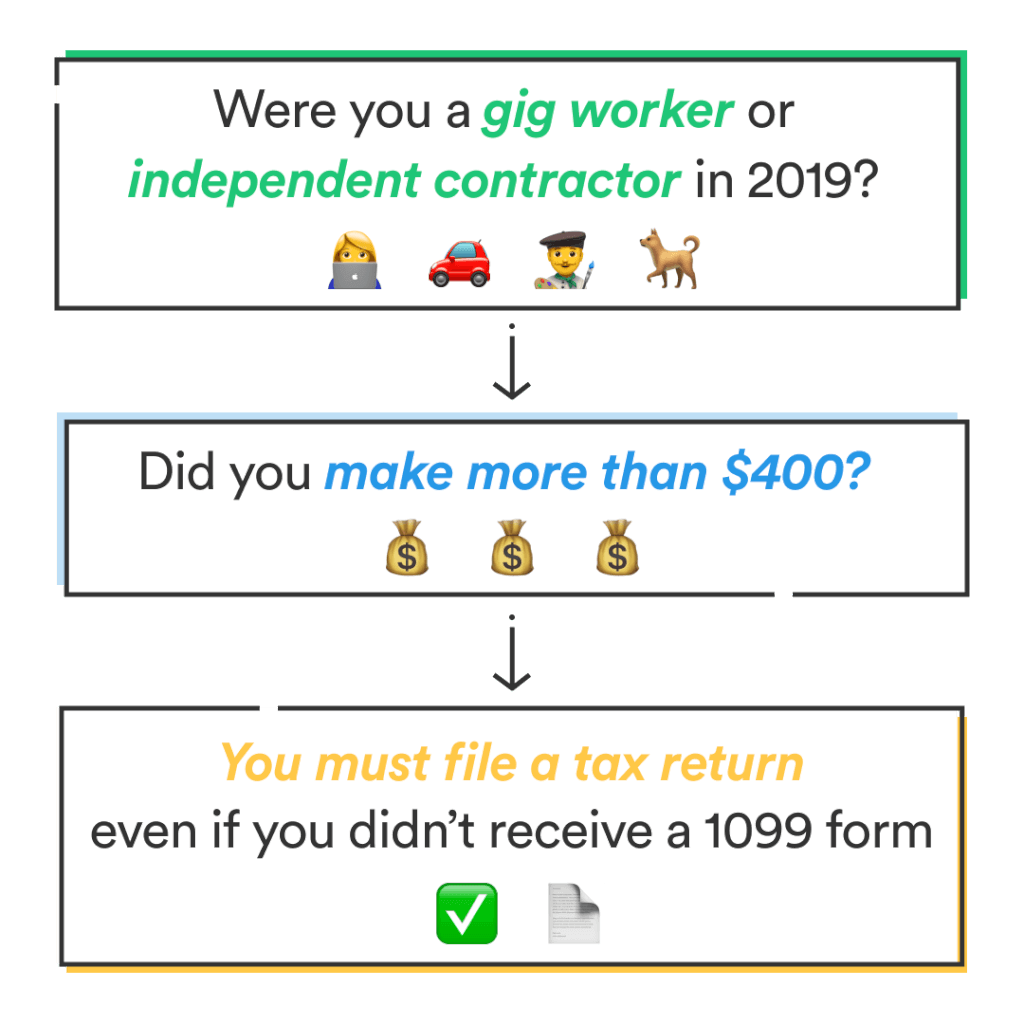

Use this SelfEmployment Tax Calculator to estimate your tax bill or refund This tool uses the latest information provided by the IRS including annual changes and those due to tax reform Gather your tax documents including 1099s, business receipts, bank records, invoice payments, and related documents to fill in the drop down sectionsYou made $400 in selfemployed/1099 income For the full details, check out the IRS's clarification "Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed" While the annual return is due on Tax Day (April 15th), quarterly tax payments are due every quarter Make sure to pay estimated63 000 00 Tax Calculator 21 22 21 Tax Refund Calculator california salary paycheck calculator How Much Should I Set Aside For Taxes 1099 california salary paycheck calculator Are You In The U S Middle Class Try Our Income Calculator Pew Research Center california salary paycheck calculator

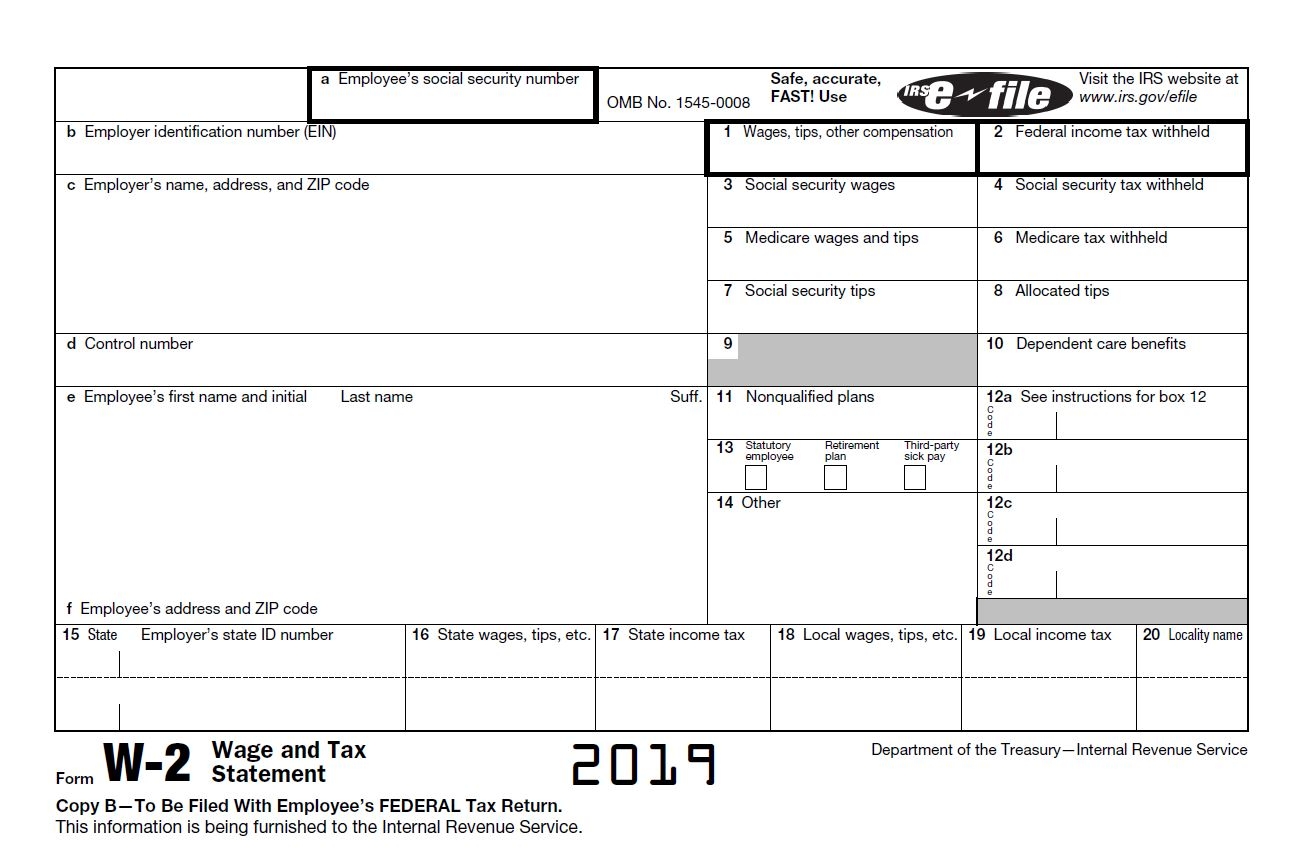

How To Read A W 2 Earnings Summary Credit Karma Tax

Gig Economy Improving The Federal Tax System For Gig Economy Work

If you're a 1099 worker (or a small business that employs 1099 workers) seeking a Paycheck Protection Program (PPP) loan, you likely have questions about whether or not you qualify for a PPP loan, what you need to apply, and how potential loan forgiveness will work We've put together some of the most common questions we've received surrounding PPP and 1099 Generating pay stubs for 1099 independent contractors The 1099MISC form, also called the 1099 miscellaneous form or simply 1099 form, is an informational form that covers a broad range of payments over a specified periodFree payroll tax, paycheck calculator, print paychecks & paystubs eSmartPayroll – IRS, SSA and States authorized payroll forms W2, W2c, 1099misc, correction, 941, 940 and State forms, including converting ICESA, MMREF files to XML for California EDD form DE9C and others

How To Apply For A Ppp Loan If You Re Self Employed Nav

The Ultimate Guide To Doing Your Taxes In 19 Money

When is 1099MISC form required?Payroll calculator, California 04 Computes and tracks California payroll taxes (FedCA, Medicare, social security tax, State tax, elective deferral, etc) Use with Microsoft Word and Windows A 8109 calculator with data import is included for easy tax payment calculation Simple and fast for managing payroll Price $2500 Add to Cart See DemoWhether it's grosstonet calculations, federal and statespecific tax rates, the latest payroll insights, or a payroll solution that you seek, our hope is that

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

/how-to-calculate-your-unemployment-benefits-2064179-v2-5bb27c7646e0fb0026d9374f.png)

How To Calculate Your Unemployment Benefits

Use Gusto's hourly paycheck calculator to determine withholdings and calculate takehome pay for your hourly employees in California Simply enter their federal and state W4 information as well as their pay rate, deductions and benefits, and we'll crunch the numbers for youA list of job recommendations for the search 1099 employee paycheck calculator is provided here All of the job seeking, job questions and jobrelated problems can be solved Additionally, similar jobs can be suggestedThe calculator below will help you compare the most relevant parts of W2 vs 1099 by looking at how the two options affect your income and tax situation, but it's important to note that this is not an exact calculation of your taxes because many other factors outside the scope of this comparison can affect your tax situation

How To Avoid Paying Taxes On 1099 Misc

1

With Social Security at 124% and Medicare at 29%, SelfEmployment is a major cost of 153% (right off the top, before there's any income taxes paid) This tax calculator shows these values at the top of your results If you're new to personal taxes 153% sounds likeWages and tax statement (W2 and/or 1099, including 1099 MISC, 1099G, 1099R, 1099SSA, 1099DIV, 1099SS, 1099INT) It must contain the person's first and last name, income amount, year, and employer name (if applicable) Employer statement The employer statement must Be on company letterhead or state the name of the company Be signed by theIf you make $55,000 a year living in the region of California, USA, you will be taxed $12,070 That means that your net pay will be $42,930 per year, or $3,577 per month Your average tax rate is 2% and your marginal tax rate is 397% This marginal tax rate means that your immediate additional income will be taxed at this rate

Waiting Time Penalty For Final Wages In California Explained 21

/when-you-can-expect-to-get-your-first-and-last-paycheck-2060057_FINAL-5c6c1bc446e0fb000165cba9.png)

When You Can Expect To Get Your First And Last Paycheck

You must report the income on your personal tax return and you must pay both income tax and selfemployment tax (Social Security/Medicare) on this income For taxes and beyond, Form 1099NEC now must be used to report payments to nonemployees, including independent contractors Form 1099MISC is now bused to report other types of payments Take California's LLC tax as an example Even if your company had zero profits, being an LLC means you'll have to pay an $800 fee to the California Franchise Tax Board!California Hourly Paycheck Calculator Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local W4 information This California hourly paycheck calculator is perfect for those who are paid on an hourly basis See FAQs below California

Free Tax Calculator Tax Return Estimator Liberty Tax

Ttb Products

This calculator provides an estimate of the SelfEmployment tax (Social Security and Medicare), and does not include income tax on the profits that your business made and any other income For a more robust calculation, please use QuickBooks SelfEmployed 18 SelfEmployed Tax Calculator1099 Employee P&A Beverages Inc is an independent contractor located at Saticoy Street in Los Angeles, California that received a Coronavirusrelated PPP loan from the SBA of $16, in May, The company has reported itself as a White male owned business, and employed at least five people during the applicable loan loan period1099 paycheck calculator Posted on 9th September by HopSkipDrive is currently only working in the greater Los Angeles areaGett is an ondemand rideshare service that allows drivers to keep 100% of their tips and earn more during peak hoursGett is an on demand economy rideshare service that allows drivers to keep 100% of their tips and earn more during peak hours

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Income Tax Guide For The Simple Dollar

Other Services eSmart Payroll provides IRS authorized payroll efile services Prepare, print and file form 941, 940, 944, W2, W2C, 1099misc, correction and convert California DE9C ICESA, MMREF to XML, etc;

Calculating Federal Taxes And Take Home Pay Video Khan Academy

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

1099 Workers Vs W 2 Employees In California A Legal Guide 21

Paycheck Manager Posts Facebook

The Independent Contractor Tax Rate Breaking It Down Benzinga

Fha Loan With 1099 Income Fha Lenders

Form 1099 Div Dividends Distributions Nerdwallet

1

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Are Workers Compensation Benefits Taxable In California Workers Compensation Attorney

How To File Taxes As A Freelancer Chime

How Will The Tax Reform Affect W 2 And 1099 Tax Filings

Publication 926 21 Household Employer S Tax Guide Internal Revenue Service

Estimated Tax Payments For Independent Contractors A Complete Guide

/when-you-can-expect-to-get-your-first-and-last-paycheck-2060057_FINAL-5c6c1bc446e0fb000165cba9.png)

When You Can Expect To Get Your First And Last Paycheck

Is Paid Family Leave Taxable Employee Contributions Benefits

Vermont Income Tax Vt State Tax Calculator Community Tax

Self Employment Tax Hub For 21

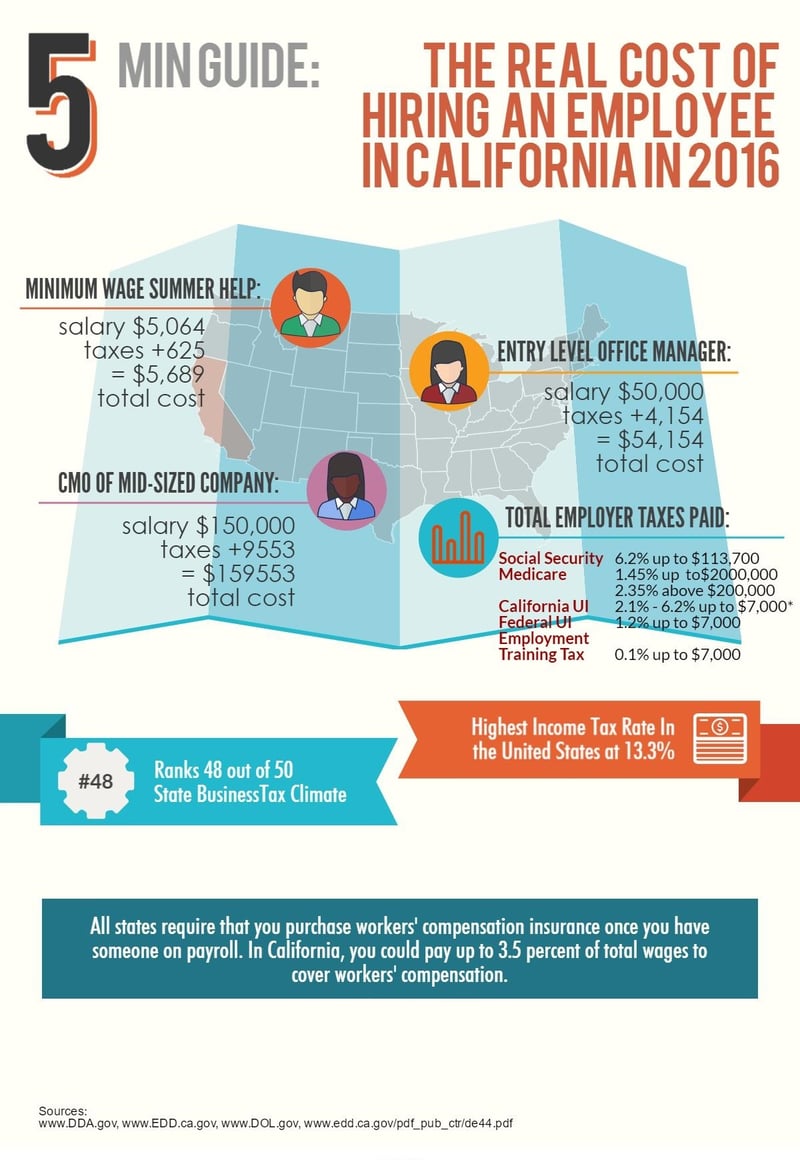

The True Cost To Hire An Employee In California Infographic

The Complete J1 Student Guide To Tax In The Us

Tax Calculator And Refund Estimator 21 Turbotax Official

1

How To Calculate Your 1099 Hourly Rate No Matter What You Do

1099 Workers Vs W 2 Employees In California A Legal Guide 21

What Are Employee And Employer Payroll Taxes Ask Gusto

1099 Misc Instructions And How To File Square

What You Need To Know About Instacart 1099 Taxes

What Is Form 1099 G H R Block

4 Possible Tax Surprises And How To Cope With Them Oregonlive Com

Esmart Payroll Tax Software Filing Efile Form 1099 Misc 1099c W2 W2c 940 941 De9c E File Corrections

The Ultimate Guide To Doing Your Taxes In 19 Money

When Are Taxes Due Tax Deadlines For 21 Bankrate

Paycheck Protection Program Calculator Cares Act Relief

Free Tax Calculator Tax Return Estimator Liberty Tax

29 Free Payroll Templates Payroll Template Payroll Checks Statement Template

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Home

:max_bytes(150000):strip_icc()/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

Esmart Payroll Tax Software Efile 1099misc 1099c W2 W2c 940 941

How To Read Your W 2 What If Your Company Uses A Peo Worklogic Hr

California Personal Income Tax Laws

How To Calculate Your Ppp Loan Amount Bluevine

Www Sdcoe Net Business Services Payroll Services Documents Section23 Deceased Employees Pdf

1099 Workers Vs W 2 Employees In California A Legal Guide 21

How To Calculate Self Employment Tax In California Newpoint Law Group

Free Tax Estimate Excel Spreadsheet For 19 21 Download

What Is Casdi Employer Guide To California State Disability Insurance Gusto

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Free Tax Estimate Excel Spreadsheet For 19 21 Download

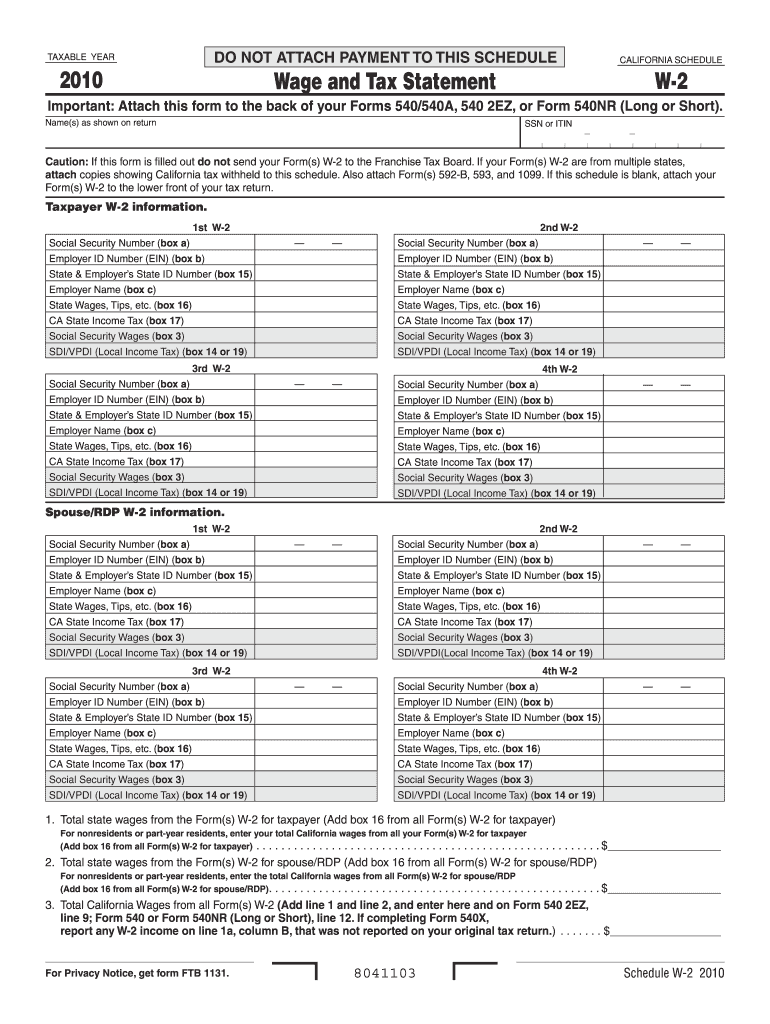

10 21 Form Ca Ftb Schedule W 2 Fill Online Printable Fillable Blank Pdffiller

Doordash Tax Calculator 21 What Will I Owe How Bad Will It Hurt

1099 Workers Vs W 2 Employees In California A Legal Guide 21

Nanny Pay And Salary Calculator Care Com

Esmart Payroll Tax Software Efile 1099misc 1099c W2 W2c 940 941

Paycheck Manager Posts Facebook

How To File Taxes As A Freelancer Chime

State Withholding Form H R Block

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

How To File Taxes As An Independent Contractors H R Block

How To Take Taxes Out Of Your Employees Paychecks With Pictures

Gig Economy Improving The Federal Tax System For Gig Economy Work

Create Pay Stubs Instantly Generate Check Stubs Form Pros

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

/how-to-calculate-your-unemployment-benefits-2064179-v2-5bb27c7646e0fb0026d9374f.png)

How To Calculate Your Unemployment Benefits

Ttb Products

Independent Contractor Taxes Guide 21

Federal Income Tax Calculator Credit Karma

How To File A Tax Return With A 1099 Independent Contractor Tax Preparation Youtube

Human Capital Management Solutions Payday Workforce Payroll Tax

How Much Should I Save For Taxes Grubhub Doordash Uber Eats

California Tax And Labor Law Summary Care Com Homepay

Childsupport Ca Gov Wp Content Uploads Sites 252 Misc Calculator User Guide 1 Pdf

Human Capital Management Solutions Payday Workforce Tax Help

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png)

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

The Cost Of Hiring Employees In California Infographic

0 件のコメント:

コメントを投稿